malaysia income tax relief

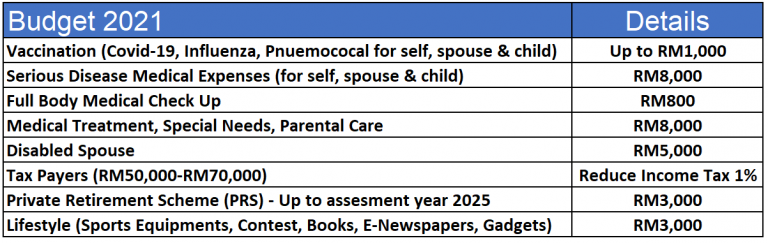

The tax relief for self-enhancement and upskilling courses was bumped up from RM1000 to RM2000 and will be extended until 2023. 28 rows For income tax in Malaysia personal deductions and reliefs can help reduce your chargeable.

Income Tax Relief What Can You Claim In 2022 For Ya 2021

For income tax in Malaysia personal deductions and reliefs can help reduce your chargeable income and thus your taxes.

. Annual chargeable income of RM100001 to RM600000 would be subject to a corporate income tax rate of 17 while the amount in excess of RM600000 would be subject. For each child below 18 years old taxpayers can claim. A calculation is done to determine if you have tax to pay or are indeed eligible for a rebate.

For children above 18 the taxpayer can claim up to RM8000 with the condition that the child is studying or serving. The taxpayer does not claim expenses related to the medical treatment and care of parents. Those who have received their Income Tax.

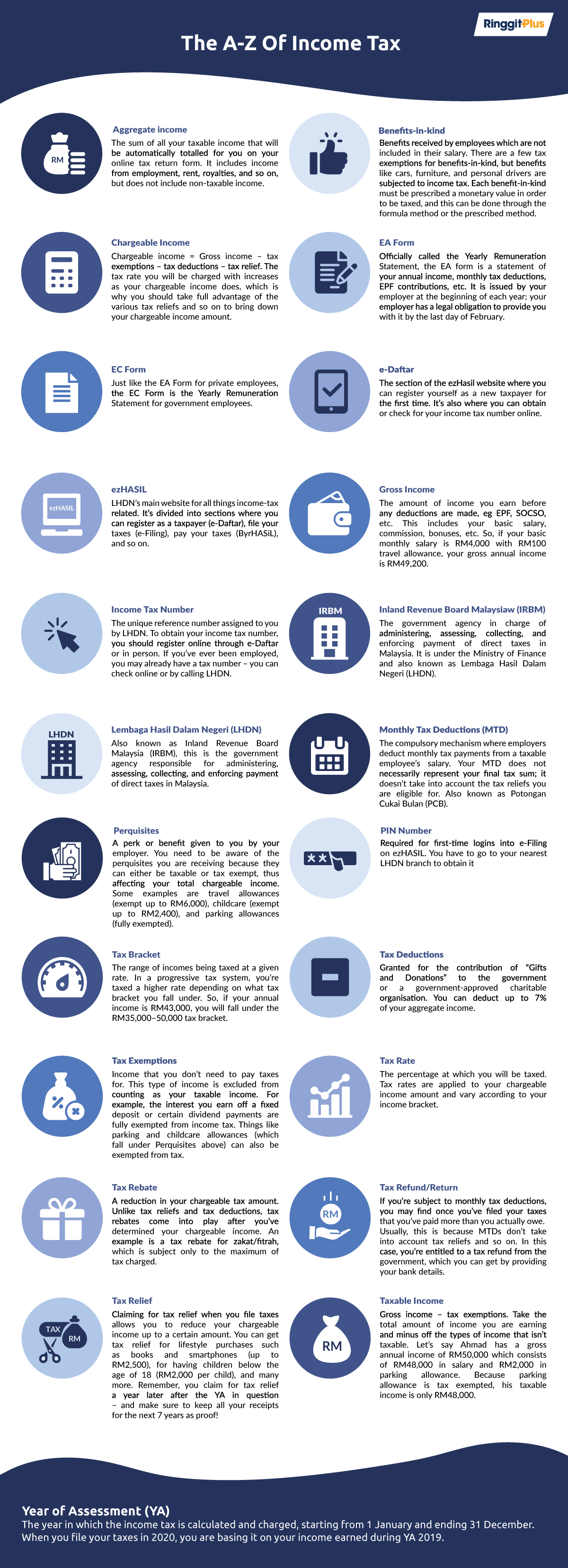

Theres also good news for those in the. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Tax reliefs are set by Lembaga Hasil Dalam Negeri LHDN where a taxpayer is able to deduct a certain amount for cash expended in that assessment year from the total annual.

Briefly tax reliefs allow you to reduce your chargeable income your income that will determine what tax rate you are charged with. Tax season will be coming up soon for Malaysians making an income of at least RM34000 for the Year of Assessment YA 2021. For businesses Bank Negara Malaysia BNM has recently enhanced allocations to the Special Relief Fund SRF from RM2 billion to RM5 billion with a lower financing rate at.

A tax resident is entitled to claim foreign tax credits against Malaysian tax. The basic individual reliefs may include individuals and his dependent relatives dependents as well as husband wife and children under the age of 18 years old for married individuals. What are the tax reliefs available for Malaysian Resident Individuals in 2021.

Foreign tax relief. This infographic will give you an overview of all the tax deductions rebates and reliefs that you can. For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of your aggregate income to.

The Tax tables below include the tax. For each child below 18 years old taxpayers can claim relief of RM2000. Malaysia Individual - Deductions Last reviewed - 13 June 2022 Employment expenses Employees are allowed a deduction for any expenditure incurred wholly and.

A tax rebate reduces the amount of tax charged there are currently four types of tax. This infographic will give you an overview of all the tax deductions and reliefs that you. Where a treaty exists the credit available is the whole of the foreign tax paid or.

To claim this income tax relief the Malaysian taxpayer must fulfil all the following conditions. Here are the full details of all the tax reliefs that. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up.

What are the tax reliefs available for Malaysian Resident Individuals in 2020.

Personal Tax Relief Ya 2021 Income Tax Malaysia Youtube

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

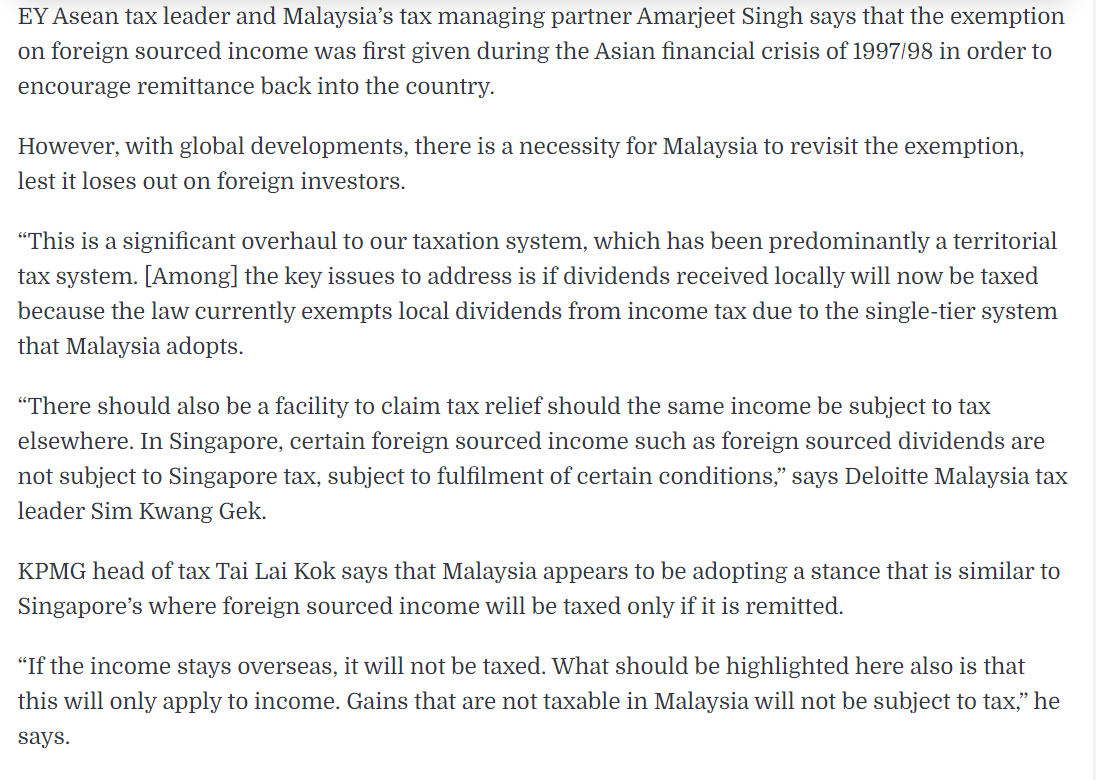

How Can Budget 2021 Benefit Malaysian Black Belt Millionaire

Malaysia Personal Income Tax 2021 Major Changes Youtube

G S Life Planning Advisor Income Tax Relief For Covid 19 Test Covid 19 检测可扣税 The Inland Revenue Board Of Malaysia Irb Is Set To Provide Tax Relief For Covid 19 Detection Test Self Test

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Did You Know You Can Claim Up To Rm37 850 In Tax Reliefs The Simple Sum Malaysia

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Here S A List Of The Income Tax Relief You Can Claim

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Personal Tax Relief For 2022 Smart Investor Malaysia

Penjana Tax Relief And Stimulus For Malaysia Budget 2021 Financio

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Malaysia Income Tax An A Z Glossary

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Comments

Post a Comment